In the ever-evolving landscape of the banking industry, the efficient delivery of technology solutions is crucial for maintaining a competitive edge. However, many banks in Pakistan continue to rely on the traditional waterfall model for their software development life cycle (SDLC). This approach not only leads to project delays but also hampers the ability to deploy changes frequently. In this bl

What is Waterfall model?

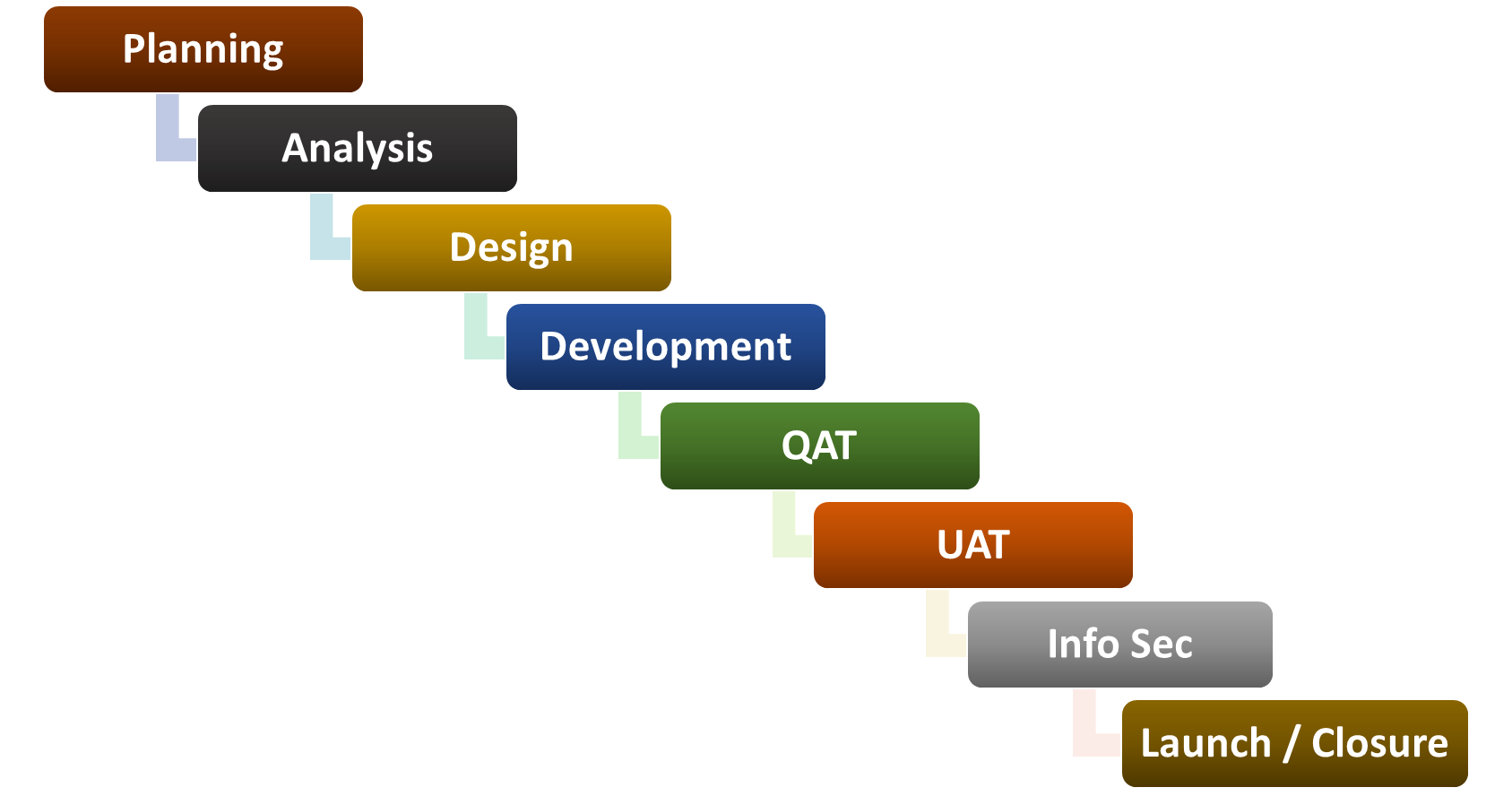

The waterfall model is a linear, sequential approach to software development that consists of distinct phases: requirements gathering, design, development, testing, and deployment. While it provides structure and predictability, it often fails to accommodate changes and adapt to evolving customer needs.

Waterfall SLDC (Software Development Life Cycle)

Waterfall Model (SDLC) Usually Followed by Banks:

What is Agile?

Agile is an iterative and collaborative approach to software development that emphasizes flexibility, customer collaboration, and continuous improvement. It promotes adaptive planning, self-organizing teams, and frequent feedback loops to deliver high-quality solutions.

Agile Attributes

* By adopting an Agile approach, our bank can benefit from faster time-to-market, increased customer satisfaction, and greater flexibility and adaptability in the face of changing market conditions and customer needs.

Agile SLDC (Software Development Life Cycle

There are several Agile methodologies available, but Scrum is one of the most popular and widely adopted methodologies for software development because it emphasizes iterative and incremental development, self-organizing teams, and continuous feedback and improvement. Here are the key steps in the agile software development life cycle

Best Practices for Agile Implementation in Banking Sector

Challenges & Risk of Agile in Banking Sector

Estimation in Scrum

Scrum methodology is an Agile approach that emphasizes collaboration, flexibility, and continuous improvement. One of the critical elements in Scrum is estimation, which involves predicting the time and effort required to complete a task or project.

Key Points:

Estimation in Scrum is done using story points or ideal days

Story points are a relative measure of the effort required to complete a task, whereas ideal days are a measure of the actual time required to complete a task.

The Scrum team estimates the backlog items during the Sprint Planning meeting.

The Product Owner prioritizes the backlog items based on the estimates and value they bring to the product.

Estimation is an iterative process in Scrum, and the team continually refines their estimates as they gain more knowledge and experience.

Best Practices:

Estimation should be done collaboratively by the entire Scrum team.

The team should avoid overcommitting and be realistic with their estimates.

The estimates should be updated regularly, and the team should communicate any changes to the Product Owner.

Conclusion:

Estimation is a crucial element in the Scrum methodology, and it helps the team plan their work and ensure they deliver the most valuable product increments in each Sprint.

Waterfall Vs Agile

The banking industry in Pakistan must adapt to the changing landscape of technology and customer expectations. By embracing the agile methodology, banks can overcome the challenges posed by the waterfall model. Agile empowers teams to deliver solutions faster, respond to customer feedback, and drive innovation. As banks transition from waterfall to agile, they will experience improved efficiency, enhanced collaboration, and ultimately gain a competitive advantage in the market. By embracing agile, banks in Pakistan can unlock their potential for rapid innovation and adaptability, empowering them to thrive in the digital era of banking.