Agriculture remains the backbone of Pakistan’s economy, contributing around 19% to the GDP and employing nearly 38% of the labor force. However, farmers face numerous challenges, including climate change, poor advisory services, limited access to modern machinery, and inefficient lending processes. Banks can play a crucial role in addressing these challenges by leveraging technology, offering sp

Banks can partner with fintech and agritech companies to provide smart advisory services to farmers. By using satellite imagery and geolocation data, banks can help farmers select the best crops based on climate conditions, soil fertility, and water availability.

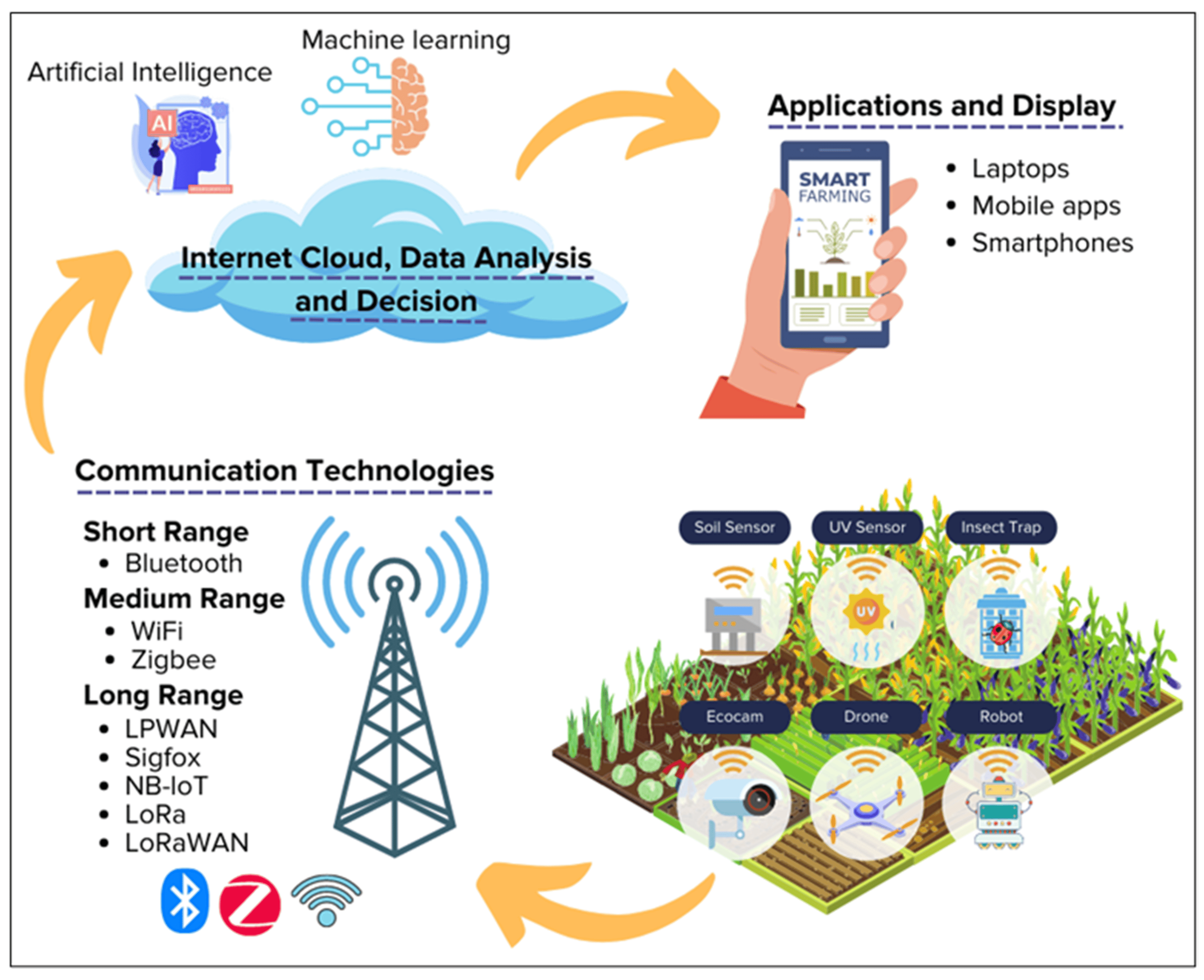

Artificial Intelligence (AI) can revolutionize agriculture by helping farmers make data-driven decisions, improving yield predictions, and optimizing resource usage.

Due to global warming, farmers need access to financing solutions that support climate-resilient agriculture. Banks can introduce special loans for drought-resistant crops, greenhouse farming, and modern irrigation systems.

Mechanization is crucial for increasing productivity and efficiency. Banks can facilitate leasing and financing options for agri-machinery such as tractors, harvesters, and irrigation equipment.

Banks can help farmers move towards cashless transactions by integrating digital payment solutions. Additionally, they can connect farmers directly to buyers and distributors to ensure fair pricing.

Unpredictable weather conditions and pest attacks can lead to financial losses. Banks should introduce crop insurance products tailored to small farmers.

Banks in Pakistan have the potential to revolutionize the agriculture sector by leveraging technology, providing tailored financial solutions, and facilitating access to advisory services. By integrating AI-driven recommendations, climate-resilient financing, and smart leasing programs, banks can empower farmers to adopt modern techniques, increase yields, and contribute to a more sustainable agricultural economy. Prosperous Pakistan begins with empowered farmers

Your email address will not be published. Required fields are marked *